About a travel insurance for trekking in Nepal

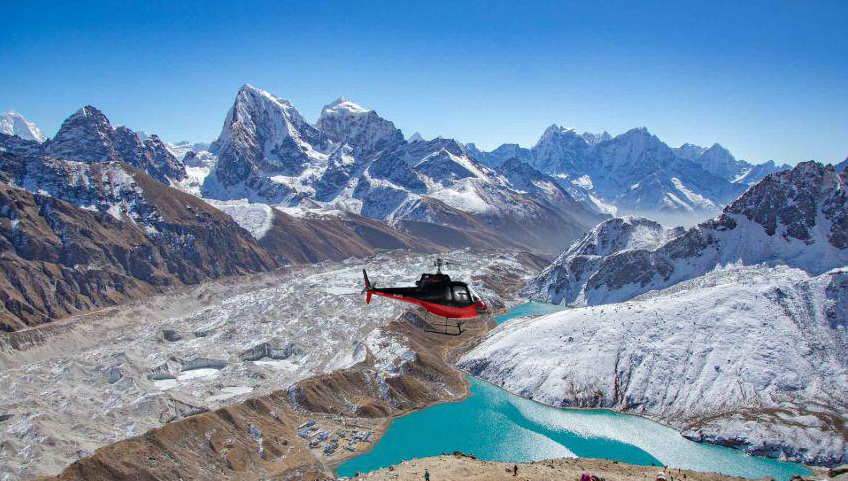

Travel insurance is a crucial safeguard for anyone trekking in the mountains, where unpredictable weather, high altitude risks, and remote locations can present significant challenges. Trekking in destinations like Everest Base Camp, Annapurna Circuit, or Manaslu exposes adventurers to potential altitude sickness, injuries, and unforeseen emergencies that may require immediate medical attention or even helicopter evacuation.

Moreover, without proper insurance, the cost of emergency rescues and medical treatment in remote Himalayan areas can be exceptionally high. Travel insurance not only covers medical emergencies but also provides financial protection against trip cancellations, lost baggage, and delays, ensuring peace of mind throughout the journey.

Given the rugged terrain and limited healthcare facilities in mountain regions, purchasing comprehensive travel insurance with high mountain sickness coverage and emergency evacuation benefits is not just advisable—it is an absolute necessity for a safe and stress free adventure.

Is Travel Insurance Mandatory for High Pass Trekking in the Himalayas?

Absolutely! Travel insurance is mandatory for higher passes trekking in the Himalayas, particularly for demanding routes like Everest Three Passes, Tilman Pass, Larkya La Pass, and Thorong La Pass. High altitude trekking comes with inherent risks, including altitude sickness, extreme weather conditions, and injuries in remote areas with limited medical facilities.

Furthermore, most trekking agencies and Nepal’s trekking permit regulations for restricted areas require trekkers to have comprehensive insurance that includes emergency medical treatment and helicopter evacuation. Without adequate coverage, the cost of rescue operations can be overwhelming, as helicopter evacuations alone can cost thousands of dollars.

To ensure both safety and financial security, trekkers must obtain insurance specifically designed for high altitude trekking, covering medical emergencies, evacuations, and unforeseen travel disruptions before setting out on their Himalayan adventure.

Trekking Insurance – Better Prepared Than Sorry!.

Trekking insurance is essential for any adventure, especially in the Himalayas, where unpredictable conditions can pose significant risks. Your safety is our top priority, and having travel insurance is mandatory for joining our trips.

A comprehensive policy protects you from unexpected events, covering everything from trip cancellations to medical emergencies requiring helicopter evacuation. When trekking at high altitudes, we strongly recommend insurance that includes rescue and medical treatment expenses. However, for trips to Tibet, evacuations are only possible by road, making helicopter rescue coverage unnecessary.

While we do not sell insurance, we can recommend providers that past clients have trusted. If your adventure involves peak climbing or mountaineering with technical gear, specialized coverage—such as that offered by the British Mountaineering Club—is crucial. Before purchasing any policy, always review the details carefully.

About International Travel Health Insurance.

International travel health insurance is a type of insurance that provides coverage for medical expenses, emergency evacuation, trip cancellation, and other unforeseen events that may occur while traveling abroad.

This type of insurance is designed to protect travelers from the high costs of medical treatment in foreign countries, as well as provide assistance and support in case of emergencies.

International travel health insurance policies can vary widely in terms of coverage and cost, so it’s important for travelers to carefully review their options and choose a policy that meets their specific needs.

Importance of travel insurance especially to NEPAL?

Hiking in the Nepalese Himalayas can be an incredible experience, but it also involves certain risks, such as altitude sickness, extreme weather conditions, and accidents on rugged terrain. Travel insurance can provide you with financial protection in case of unforeseen events that may occur during your hike. Here are some reasons why travel insurance is crucial while hiking in the Nepalese Himalayas:

1. Trip cancellation or interruption:

If unexpected events, like a family emergency, force you to cancel or shorten your trip, travel insurance can refund you for non refundable expenses you’ve already incurred, such as flights, accommodations, and permits.

2. Emergency medical expenses:

If you suffer an injury or fall ill during your hike, medical treatment can be very expensive, particularly in remote areas. Travel insurance can cover the costs of emergency medical treatment and evacuation, including helicopter rescue.

3. Loss or theft of baggage:

When hiking in the Himalayas, you may need to carry important and expensive gear such as trekking poles, sleeping bags, and cameras. In case of loss, theft, or damage to your belongings, travel insurance can provide compensation.

4. Personal liability:

In the event of an accident involving other hikers or locals, travel insurance can cover the costs of legal fees and compensation if you are found liable.

Overall, travel insurance can give you peace of mind while hiking in the Nepalese Himalayas and allow you to enjoy your trip without worrying about the financial consequences of unforeseen events. It is important to read and understand the policy carefully, including any exclusions, limitations, and coverage terms specific to hiking or adventure activities.

How to Choose the Best Travel Insurance Plan?

Choosing the best travel insurance plan requires careful consideration of your specific needs and travel circumstances. Start by assessing the coverage options offered by various insurance providers, including medical coverage, trip cancellation/interruption coverage, emergency evacuation, and baggage loss/damage coverage.

Consider the level of coverage you need based on the nature of your trip, such as adventure activities or pre existing medical conditions. Compare quotes from different insurers to find a balance between coverage and cost. Additionally, read reviews and seek recommendations from other travelers to gauge the reputation and reliability of the insurance company.

How to Get Insurance for International Travel?

To get insurance for international travel, start by researching reputable insurance companies that offer coverage for travelers. You can do this by searching online or asking for recommendations from friends, family, or travel agencies.

Once you’ve identified a few potential insurers, compare their coverage options, limits, and prices to find a plan that suits your needs. When applying for insurance, you’ll typically need to provide information about your trip, such as the dates of travel, destinations, and any pre existing medical conditions. After selecting a plan, complete the application process and make the necessary payments to secure your coverage.

Determine the extent of coverage required for your trip?

When deciding how much coverage you need for your trip to Nepal, consider various factors such as the length of your stay, the activities you plan to engage in, and any specific health concerns.

Ensure your insurance includes coverage for medical expenses, emergency evacuation, and trip cancellation or interruption. Given Nepal’s terrain and the possibility of engaging in adventurous activities like trekking, consider a policy that covers these activities and provides adequate medical coverage for high altitude areas.

Additionally, consider coverage for lost or damaged baggage and personal liability. It’s important to assess your individual needs and risks to determine the appropriate level of coverage for your trip.

When is the Best Time to Purchase Insurance?

The best time to purchase insurance for your trip is as soon as you book your travel arrangements. This ensures that you are covered for any unforeseen events that may occur before your trip, such as trip cancellation due to illness or unexpected emergencies.

Getting insurance early also allows you to take advantage of benefits like coverage for pre existing medical conditions, which may have waiting periods before they become effective. Additionally, purchasing insurance early gives you peace of mind knowing that you are protected from the moment you start planning your trip.

How Does International Travel Insurance Work?

International travel insurance works by providing coverage for a variety of unforeseen events that may occur while traveling abroad.

In the event of a covered incident, the traveler can file a claim with their insurance provider, providing documentation and receipts as needed. Once the claim is approved, the insurance company will reimburse the traveler for eligible expenses, up to the limits outlined in their policy.

How to file a travel insurance to claim?

To file a travel insurance to claim, You need to contact your insurance provider as soon as possible after the incident arise. Most insurance companies have a 24/7 helpline for emergencies. Collect all relevant documents related to your claim, such as receipts, medical reports, police reports (if applicable), and any other supporting documentation.

Likewise, fill out the claim form provided by your insurance company. Include all required information and be as detailed as possible. And send the completed claim form along with all supporting documents to your insurance provider. You may be able to submit the claim online, by email, or by mail, depending on the insurer’s requirements.

Keep track of your claim and follow up with your insurance provider if you haven’t received a response within a reasonable timeframe. Once your claim is processed, review the settlement offer from your insurance provider. If you agree with the offer, you may be reimbursed for your expenses.

If your claim is denied or you disagree with the settlement offer, you may have the option to appeal the decision with your insurance provider. It’s important to read and understand your travel insurance policy to know what is covered and how to file a claim.

But, to find out what paperwork you’ll need for the claim, make sure to get in touch with your travel insurance company before you leave the nation you’re visiting. Certain travel insurance companies mandate that you get in touch with them right away in the event of an emergency.

Above all, make sure you thoroughly study the insurance policy to determine the precise actions your travel insurance provider needs you to perform in order to file a claim. Make copies of any records that attest to your eligibility for payment.

What is the Cost of Travel Insurance?

The cost of travel insurance varies depending on several factors, including the traveler’s age, the duration and destination of the trip, the level of coverage selected, and any additional options or riders chosen. On average, basic travel insurance can cost anywhere from 4% to 10% of the total trip cost.

For example, for a $2,000 trip, basic insurance might cost between $80 and $200. However, this is just a rough estimate, and prices can vary widely. It’s advisable to obtain quotes from multiple insurance providers to compare prices and coverage options to find the best policy for your needs.

Is Travel Medical Insurance Worth It?

Yes, medical insurance on your travel to NEPAL is often worth it. While no one plans to get sick or injured while traveling, having medical insurance can provide peace of mind and financial protection in case of unexpected medical emergencies. Medical treatment in a foreign country can be expensive, and having insurance can help cover these costs.

Additionally, some travel insurance policies offer coverage for emergency medical evacuation, which can be lifesaving in certain situations. Overall, the relatively small cost of travel medical insurance compared to the potential expenses of medical treatment abroad makes it a wise investment for most travelers.

Disclaimer

Keep in mind that we are not experts in trekking insurance. However, the information provided below is based on our personal experience and recommendations from fellow trekkers. If you have any doubts about policy terms or limitations, we strongly advise consulting a professional insurance advisor for accurate guidance.

Get a list of travel Insurance Companies in your country advised by our previous travelers;-

Europe | America |

|

|

Australia | Canada |

|

|

Asia & Middle East | |

|